Poland - Public finance

The annual budget is presented to the Sejm in December and becomes effective for the fiscal year beginning on 1 January. A new set of economic reforms, announced in early 2002, aim to improve the country's investment climate and public finances. Privatization in the former Eastern bloc nation has been fairly successful, with approximately two-thirds of GDP now coming from the private sector. Poland was the first formerly planned economy in Eastern Europe to come out of recession and see growth in the early 90s.

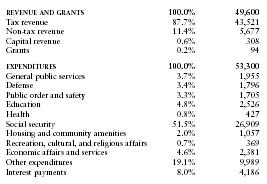

The US Central Intelligence Agency (CIA) estimates that in 1999 Poland's central government took in revenues of approximately $49.6 billion and had expenditures of $52.3 billion. Overall, the government registered a deficit of approximately $2.7 billion. External debt totaled $64 billion.

The following table shows an itemized breakdown of government revenues and expenditures. The percentages were calculated from data reported by the International Monetary Fund. The dollar amounts (millions) are based on the CIA estimates provided above.

| REVENUE AND GRANTS | 100.0% | 49,600 |

| Tax revenue | 87.7% | 43,521 |

| Non-tax revenue | 11.4% | 5,677 |

| Capital revenue | 0.6% | 308 |

| Grants | 0.2% | 94 |

| EXPENDITURES | 100.0% | 53,300 |

| General public services | 3.7% | 1,955 |

| Defense | 3.4% | 1,796 |

| Public order and safety | 3.3% | 1,705 |

| Education | 4.8% | 2,526 |

| Health | 0.8% | 427 |

| Social security | 51.5% | 26,909 |

| Housing and community amenities | 2.0% | 1,057 |

| Recreation, cultural, and religious affairs | 0.7% | 369 |

| Economic affairs and services | 4.6% | 2,381 |

| Other expenditures | 19.1% | 9,989 |

| Interest payments | 8.0% | 4,186 |

Comment about this article, ask questions, or add new information about this topic: