Italy - Public finance

Reflecting both increasing economic activity and the pressures of inflation, the Italian budget has expanded continually since 1950. The Italian economy has traditionally run a high government debt, but in recent years it has been quelled somewhat, despite lackluster growth. In 1995, the debt stood at 124% of GDP, but declined to 110.6% in 2000 and 109.4% in 2001. At that point the Italian government still had a long way to go to get down to the EU-imposed debt-to-GDP ration of 60%. Since 1996, Italy has maintained a primary budget surplus, net of interest payments, and has reduced its deficit in public administration from 1.7% of GDP in 2000 to 1.4% in 2001. However, given the high national debt, the EU remains concerned about Italy's budgetary policies.

The US Central Intelligence Agency (CIA) estimates that in 2001 Italy's central government took in revenues of about $504 billion and had expenditures of $517 billion. Overall, the government registered a deficit of approximately $13 billion.

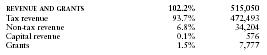

The following table shows an itemized breakdown of government revenues. The percentages were calculated from data reported by the International Monetary Fund. The dollar amounts (millions) are based on the CIA estimates provided above.

| REVENUE AND GRANTS | 102.2% | 515,050 |

| Tax revenue | 93.7% | 472,493 |

| Non-tax revenue | 6.8% | 34,204 |

| Capital revenue | 0.1% | 576 |

| Grants | 1.5% | 7,777 |

Comment about this article, ask questions, or add new information about this topic: