Singapore - Balance of payments

The traditional current account surplus is largely due to demand for non-oil exports (especially electronics) from the US, Japan, and regional countries with electronics production facilities. The account also benefits from high net investment income receipts. Total official reserves are estimated to be equal to 8.8 months of imports. A sharp contraction of imports in 1998 due to the financial crisis caused a high current account surplus, while the devalued currency caused an even larger outflow of cash from the financial accounts. Singapore's balance of payments weakened in 2001, largely due to that year's decline in trade.

The US Central Intelligence Agency (CIA) reports that in 2001 the purchasing power parity of Singapore's exports was $122 million while imports totaled $116 billion resulting in a trade deficit of $115.878 billion.

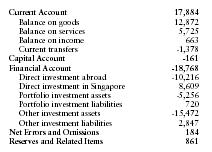

The International Monetary Fund (IMF) reports that in 2001 Singapore had exports of goods totaling $122.5 billion and imports totaling $109.6 billion. The services credit totaled $26.2 billion and debit $20.4 billion. The following table summarizes Singapore's balance of payments as reported by the IMF for 2001 in millions of US dollars.

| Current Account | 17,884 |

| Balance on goods | 12,872 |

| Balance on services | 5,725 |

| Balance on income | 663 |

| Current transfers | -1,378 |

| Capital Account | -161 |

| Financial Account | -18,768 |

| Direct investment abroad | -10,216 |

| Direct investment in Singapore | 8,609 |

| Portfolio investment assets | -5,256 |

| Portfolio investment liabilities | 720 |

| Other investment assets | -15,472 |

| Other investment liabilities | 2,847 |

| Net Errors and Omissions | 184 |

| Reserves and Related Items | 861 |

Comment about this article, ask questions, or add new information about this topic: