Cyprus - Public finance

The fiscal year follows the calendar year. Import duties and income tax are the principal sources of government revenue. The principal ordinary expenditures are education, defense, and police and fire services. Due to the introduction of a value-added tax and a more efficient tax collection system, Cyprus made steady progress in reducing its budget deficit in the early 1990s, which reached 1% of GDP in 1995. The deficit, however, due in part to a slowing economy, is now again on the increase.

Turkish Cypriots use the Turkish lira for currency, and the Turkish government reportedly provides a large part of the TRNC annual budget.

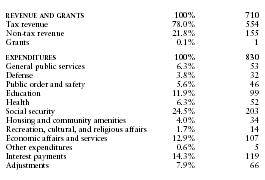

The International Monetary Fund (IMF) estimates that in 1997 Cyprus's central government took in revenues of approximately $710.9 million and had expenditures of $830.4 million including capital expenditures of $83.2 million. Overall, the government registered a deficit of approximately $120 million.

The following table shows an itemized breakdown of government revenues and expenditures in millions of US dollars. The percentages were calculated from data reported by the IMF.

| REVENUE AND GRANTS | 100% | 710 |

| Tax revenue | 78.0% | 554 |

| Non-tax revenue | 21.8% | 155 |

| Grants | 0.1% | 1 |

| EXPENDITURES | 100% | 830 |

| General public services | 6.3% | 53 |

| Defense | 3.8% | 32 |

| Public order and safety | 5.6% | 46 |

| Education | 11.9% | 99 |

| Health | 6.3% | 52 |

| Social security | 24.5% | 203 |

| Housing and community amenities | 4.0% | 34 |

| Recreation, cultural, and religious affairs | 1.7% | 14 |

| Economic affairs and services | 12.9% | 107 |

| Other expenditures | 0.6% | 5 |

| Interest payments | 14.3% | 119 |

| Adjustments | 7.9% | 66 |

Comment about this article, ask questions, or add new information about this topic: