El Salvador - Public finance

Most current public revenues come from taxes, fees, and fines. Municipal taxes and fees are subject to approval by the Ministry of the Interior. Until the early 1980s, government fiscal operations had generally shown surpluses; these enabled the government to sustain a growing volume of capital expenditures, resulting in a higher government share in total investments. Improved tax collection in 1998 resulted in approximately 56% of government revenues being attributed to the VAT. The use of the colón is being phased out; the economy will eventually be completely dollarized and the Central Bank dissolved by the end of 2003.

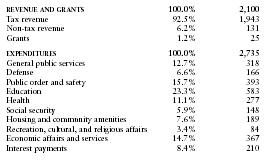

The US Central Intelligence Agency (CIA) estimates that in 2001 El Salvador's central government took in revenues of approximately $2.1 billion and had expenditures of $2.5 billion. Overall, the government registered a deficit of approximately $400 million. External debt totaled $4.9 billion.

The following table shows an itemized breakdown of government revenues and expenditures. The percentages were calculated from data reported by the International Monetary Fund. The dollar amounts (millions) are based on the CIA estimates provided above.

| REVENUE AND GRANTS | 100.0% | 2,100 |

| Tax revenue | 92.5% | 1,943 |

| Non-tax revenue | 6.2% | 131 |

| Grants | 1.2% | 25 |

| EXPENDITURES | 100.0% | 2,735 |

| General public services | 12.7% | 318 |

| Defense | 6.6% | 166 |

| Public order and safety | 15.7% | 393 |

| Education | 23.3% | 583 |

| Health | 11.1% | 277 |

| Social security | 5.9% | 148 |

| Housing and community amenities | 7.6% | 189 |

| Recreation, cultural, and religious affairs | 3.4% | 84 |

| Economic affairs and services | 14.7% | 367 |

| Interest payments | 8.4% | 210 |

Comment about this article, ask questions, or add new information about this topic: