Brazil - Public finance

The Brazilian fiscal year coincides with the calendar year. The budget, prepared under the supervision of the Ministry of Planning and Economic Coordination, represents the government's plans for financing administrative operations and capital expenditures. Budgetary deficits increased considerably in the 1960s. The government's objective—to hold total expenditures fairly constant while raising the share of capital outlays—was achieved by an austerity policy. Although the federal budget deficit was reduced in real terms during the late 1960s, fiscal problems continued to be a major source of inflationary pressure, with revenues hovering between 14.5% and 16.5% of GNP and total government expenditures in the range of 17.5% to 19%. Government revenue increased considerably, and each year the real deficit was reduced below the previous year's level both absolutely and relatively. Public spending was stepped up, particularly transfer payments; transfers of capital to decentralized agencies increased, although direct investment by the central government fell off. Thus, more capital was invested in basic infrastructural projects.

Increases in both revenues and expenditures were rapid during the 1970s, but the pattern of decreasing deficits continued. The budgets for 1973 and 1974 actually showed a surplus, although the realized surplus in 1974 fell far short of the budgeted surplus. There was a budget deficit in 1975, but surpluses were recorded annually during 1976–80. One of the principal causes of Brazil's financial instability in the 1980s was the rate at which public spending exceeded revenues. Following another stabilization program in 1990, a budget surplus of 1.4% of GDP was recorded, but deteriorated to a deficit of 1.7% of GDP by 1992. During the 1990s, the budget remained in deficit by about 4.0% of GDP, but in 1999, the budget recorded a deficit equal to 9.5% of GDP due to the devaluation of the real. This figure had declined to about 4.2% by 2002. Public spending accounts for about one-third of GDP in Brazil.

The US Central Intelligence Agency (CIA) estimates that in 2000 Brazil's central government took in revenues of approximately $100.6 billion and had expenditures of $91.6 billion. Overall, the government registered a surplus of approximately $9 billion. External debt totaled $251 billion.

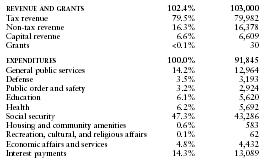

The following table shows an itemized breakdown of government revenues and expenditures. The percentages were calculated from data reported by the International Monetary Fund. The dollar amounts (millions) are based on the CIA estimates provided above.

| REVENUE AND GRANTS | 102.4% | 103,000 |

| Tax revenue | 79.5% | 79,982 |

| Non-tax revenue | 16.3% | 16,378 |

| Capital revenue | 6.6% | 6,609 |

| Grants | <0.1% | 30 |

| EXPENDITURES | 100.0% | 91,845 |

| General public services | 14.2% | 12,964 |

| Defense | 3.5% | 3,193 |

| Public order and safety | 3.2% | 2,924 |

| Education | 6.1% | 5,620 |

| Health | 6.2% | 5,692 |

| Social security | 47.3% | 43,286 |

| Housing and community amenities | 0.6% | 583 |

| Recreation, cultural, and religious affairs | 0.1% | 62 |

| Economic affairs and services | 4.8% | 4,432 |

| Interest payments | 14.3% | 13,089 |

Comment about this article, ask questions, or add new information about this topic: