Swaziland - Public finance

In the past, the government maintained a prudent fiscal policy by avoiding large deficits and restricting public sector growth. From 1987 to 1991, large budgetary surpluses were registered, and the government began making repayments on the external debt as a net creditor to the bank. Budgetary deficits during the 1990s reflected extravagant government spending on the monarchy and his family. The civil service was overstaffed as well, prompting a reduction of 5,000 employees in 2000. South African Customs Union receipts accounted for 54% of government revenue in 1999, while income tax contributed about 25% (half corporate, half personal).

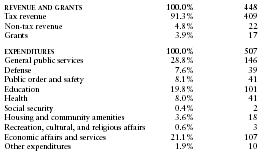

The US Central Intelligence Agency (CIA) estimates that Swaziland's central government took in revenues of approximately $448 million in 2001/2002 and had expenditures of $506.9 million including capital expenditures of $147 million. Overall, the government registered a deficit of approximately $58.9 million. External debt totaled $336 million.

The following table shows an itemized breakdown of government revenues and expenditures. The percentages were calculated from data reported by the International Monetary Fund. The dollar amounts (millions) are based on the CIA estimates provided above.

| REVENUE AND GRANTS | 100.0% | 448 |

| Tax revenue | 91.3% | 409 |

| Non-tax revenue | 4.8% | 22 |

| Grants | 3.9% | 17 |

| EXPENDITURES | 100.0% | 507 |

| General public services | 28.8% | 146 |

| Defense | 7.6% | 39 |

| Public order and safety | 8.1% | 41 |

| Education | 19.8% | 101 |

| Health | 8.0% | 41 |

| Social security | 0.4% | 2 |

| Housing and community amenities | 3.6% | 18 |

| Recreation, cultural, and religious affairs | 0.6% | 3 |

| Economic affairs and services | 21.1% | 107 |

| Other expenditures | 1.9% | 10 |

Comment about this article, ask questions, or add new information about this topic: