The World Bank Group - International bank for reconstruction and development (ibrd)

Background

As early as February 1943, United States Undersecretary of State Sumner B. Welles urged preparatory consultation aimed at the establishment of agencies to finance reconstruction and development of the world economy after WWII. The US and the UK took leading roles in the negotiations that were to result in the formation of the IBRD and the IMF. The IBRD is the main lending organization of the World Bank Group and, like its sister institution, the International Monetary Fund (IMF), was born of the Allies' realization during World War II that tremendous difficulties in reconstruction and development would face them in the postwar transition period, necessitating international economic and financial cooperation on a vast scale. The IBRD, frequently called the "World Bank," was conceived in July 1944 at the United Nations Monetary and Financial Conference in Bretton Woods, New Hampshire, US.

Purposes

Although one of the Bank's early functions was to assist in bringing about a smooth transition from wartime to peaceful economies, economic development soon became the Bank's main object. Today, the goal of the World Bank is to promote economic development that benefits poor people in developing countries. Loans are provided to developing countries to help reduce poverty and to finance investments that contribute to economic growth. Investments include roads, power plants, schools, and irrigation networks, as well as activities like agricultural extension services, training for teachers, and nutrition-improvement programs for children and pregnant women. Some World Bank loans finance changes in the structure of countries' economies to make them more stable, efficient, and market oriented. The World Bank also provides technical assistance to help governments make specific sectors of their economies more efficient and more relevant to national development goals.

Membership

The Bank's founders envisioned a global institution, the membership of which would eventually comprise all nations. Membership in the IBRD rose gradually from 41 governments in 1946 to 184 as of July 2002.

A government may withdraw from membership at any time by giving notice of withdrawal. Membership also ceases for a member suspended by a majority of the governors for failure to fulfill an obligation, if that member has not been restored to good standing by a similar majority within a year after the suspension. Only a few countries have withdrawn their membership from the Bank, and all but Cuba (withdrew in 1960) have rejoined.

Although the Soviet Union took part in the 1944 Bretton Woods Conference, and signed the final act establishing the IMF and the IBRD, it never ratified the Articles of Agreement or paid in the 20% of its subscribed capital that was due within 60 days after the Bank began operations. Had it joined, the Soviet Union would have been the Bank's third largest shareholder, after the United States and the United Kingdom. Over the next four decades, as the Bank grew in size and scope, it couldn't fulfill its founders' intentions of being a truly global institution due to the absence of the Soviet Union. Then, at the beginning of the 1990s, as political and economic change swept through the 15 republics of the USSR, the Soviet government indicated its interest in participating in the international financial system and sought membership in the IMF and World Bank. On 15 July 1991, Soviet President Mikhail Gorbachev formally applied for membership for the USSR in the IBRD and its three affiliates (IFC, IDA and MIGA). However, by December 1991, the USSR had ceased to exist. During 1992, the Russian Federation and 15 former Soviet republics (including the Baltic states) applied for membership and were accepted. Eleven of them also applied to IDA, 14 to IFC and 15 to MIGA. To accommodate these countries, the total authorized capital of the bank was increased.

A "graduating" country is one where lending is being phased out. As of 2002 there were 27 countries that had "graduated" from the IBRD. These include (with the fiscal year of their final loan): France (1947), Luxembourg (1948), Netherlands (1957), Belgium (1958), Australia (1962), Austria (1962), Denmark (1964), Malta (1964), Norway (1964), Italy (1965), Japan (1967), New Zealand (1972), Iraq (1973), Iceland (1974), Finland (1975), Israel (1975), Singapore (1975), Ireland (1976), Spain (1977), Greece (1979), Oman (1987), Bahamas (1989), Portugal (1989), Cyprus (1992), Barbados (1993), the Republic of Korea (1995), and China (1999).

Structure

Board of Governors

All powers of the Bank are vested in its Board of Governors, composed of one governor and one alternate from each member state. Ministers of Finance, central bank presidents, or persons of comparable status usually represent member states on the Bank's Board of Governors. The board meets annually.

The Bank is organized somewhat like a corporation. According to an agreed-upon formula, member countries subscribe to shares of the Bank's capital stock. Each governor is entitled to cast 250 votes plus 1 vote for each share of capital stock subscribed by his country.

Executive Directors

The Bank's Board of Governors has delegated most of its authority to 24 executive directors. According to the Articles of Agreement, each of the five largest shareholders—the United States, Japan, Germany, France and the United Kingdom—appoints one executive director. The other countries are grouped in 19 constituencies, each represented by an executive director who is elected by a group of countries. The number of countries each of these 19 directors represents varies widely. For example, the executive directors for China, the Russian Federation, and Saudi Arabia represent one country each, while one director speaks for 24 Francophone African countries and another director represents 22 mainly English-speaking African countries.

President and Staff

The president of the Bank, elected by the executive directors, is also their chairman, although he is not entitled to a vote, except in case of an equal division. Subject to their general direction, the president is responsible for the conduct of the ordinary business of the Bank. Action on Bank loans is initiated by the president and the staff of the Bank. The amount, terms, and conditions of a loan are recommended by the president to the executive directors, and the loan is made if his recommendation is approved by them.

According to an informal agreement, the president of the Bank is a US national, and the managing director of the IMF is a European. The president's initial term is for five years; a second term can be five years or less. Past presidents of the Bank include Robert S. McNamara (1968–81), A. W. Clausen (1981–86), Barber B. Conable (1986–91), and Lewis T. Preston (1991–95). James D. Wolfensohn became president on 1 June 1995. On September 27, 1999, Mr. Wolfensohn was unanimously reappointed by the Bank's Board of Executive Directors to a second five-year term as president beginning June 1, 2000. He is the third president in World Bank history to serve a second term. He heads a staff of more than 8,000 persons from over 130 countries.

The IBRD's headquarters are at 1818 H Street, N.W., Washington, DC 20433.

Budget

A total administrative budget of US $1,924 million was approved for fiscal year 2002.

Activities

A. FINANCIAL RESOURCES

Authorized capital. At its establishment, the IBRD had an authorized capital of US$ 10 billion. Countries subscribing shares were required to pay in only one-fifth of their subscription on joining, the remainder being available on call but only to meet the IBRD's liabilities if it got into difficulties. Moreover, not even the one-fifth had to be paid in hard cash at that time. The sole cash requirement was the payment in gold or US dollars of 2% of each country's subscription. A further 18% of the subscription was payable in the currency of the member country concerned, and although this sum was technically paid in, in the form of notes bearing no interest, it could not be used without the member's permission. In 1959, each member was given an opportunity to double its subscription without any payment. Thus, for countries joining the IBRD after the 1959 capital increase and for those subscribing to additional capital stock, the statutory provisions affecting the 2% and 18% portions have been applied to only one-half of their total subscriptions, so that 1% of each subscription that is freely usable in the IBRD's operations has been payable in gold or US dollars, and 9% that is usable only with the consent of the member is in the member's currency. The remaining 90% is not paid in but is subject to call by the IBRD.

Financial Resources for Lending Purposes. The subscriptions of the IBRD's members constitute the basic element in the financial resources of the IBRD. Subscribed capital for fiscal year 2002 was about US $121.6 billion. The Bank also draws money from borrowings in the market and from earnings. In 2002, the Bank's outstanding borrowings were US $110.3 billion, raised in the capital markets of the world. The IBRD is able to raise large sums at interest rates little or no higher than are paid by governments because of confidence in the Bank engendered by its record of stablility since 1947 and the investors' knowledge that if the IBRD should ever be in difficulty, it can call in unpaid portions of member countries' subscriptions. In connection with its borrowing operations, the Bank also undertakes a substantial volume of currency and interest rate swap transactions. These swaps have enabled the IBRD to lower its fund-raising costs and to expand its direct borrowing transactions to markets and currencies in which it otherwise would not have borrowed.

B. LENDING OPERATIONS

The IBRD lends to member governments, or, with government guarantee, to political subdivisions, or to public or private enterprises.

The IBRD's first loan, US$ 250 million for postwar reconstruction, was made in the latter part of 1947. Altogether, it lent US$ 497 million for postwar reconstruction, all to European countries. The IBRD's first development loans were made in the first half of 1948. As of 30 June 2002, the cumulative total of loans made by the Bank was over US$ 371 billion.

Loan Terms and Interest Rates. The IBRD normally makes long-term loans, with repayment commencing after a certain period. The length of the loan is generally related to the estimated useful life of the equipment or plant being financed. Since July 1982, IBRD loans have been made at variable rates. The lending rate on all loans made under the variable-rate system is adjusted semiannually, on 1 January and 1 July, by adding a spread of0.5% to the IBRD's weighted average cost during the prior six months of a "pool" of borrowings drawn down after 30 June 1982. Since July 1989, only borrowings allocated to lending have been included in the cost of borrowings with respect to new loans and existing variable rate loans that are amended to apply the new cost basis. For interest periods beginning from 1 July 2002 through 31 December 2002, the variable lending rate was 5.27%. Before July 1982, loans were made at fixed rates, and, accordingly, the semiannual interest-rate adjustments do not apply to payments made on these older loans.

C. PURPOSES OF THE LOANS

The main purpose of the Bank's operations is to lend to developing member countries for productive projects in such sectors as agriculture, energy, industry, and transportation and to help improve basic services considered essential for development. The main criterion for assistance is that it should be provided where it can be most effective in the context of the country's specific lending programs developed by the Bank in consultation with its borrowers. In the late 1980s, the World Bank came under criticism that its policies, intended to encourage developing countries to restructure their economies in order to render them more efficient, were actually imposing too heavy a burden on the world's poorest peoples. This, and charges by environmentalists that World Bank lending had underwritten projects that were severely detrimental to the environment of developing countries, led to a re-thinking of the Bank's policies in the 1990s.

Implementing the Bank's Poverty Reduction Strategy. The fundamental objective of the World Bank is sustainable poverty reduction. Underpinning this objective is a two-part strategy for reducing poverty that was proposed in the World Development Report 1990. The first element is to promote broad-based economic growth that makes efficient use of the poor's most abundant asset, labor. The second element involves ensuring widespread access to basic social services to improve the well being of the poor and to enable them to participate fully in the growth of the economy. Progress in implementing the poverty-reduction strategy is clearly visible in Bank-wide statistics on new lending. At the September 1999 annual meetings of the World Bank Group and IMF, ministers agreed to link debt relief to the establishment of a poverty reduction strategy for all countries receiving World Bank/IMF concessional assistance.

Sector and Structural Adjustment Lending. Bank lending for sector adjustment and structural adjustment increasingly supports the establishment of social safety nets and the protection of public spending for basic social services.

In its assistance to countries that are preparing adjustment programs, the Bank works with them to (a) design the phasing of programs to accommodate the needs of the poor, (b) give priority to relative price changes in favor of the poor early in the reform process, (c) secure adequate resources for the provision of basic social services aimed at the poor, and (d) design social safety nets into economic-reform programs. These efforts better position of the poor to be major beneficiaries of the economic growth and associated employment opportunities that are facilitated by the implementation of adjustment programs.

Human Resource Development. Bank lending for human resource development has largely been committed for education, and its focus has been towards development of basic education. Lending for education increased from an average US$ 700 million during the 1980s to an average US$ 1,907 million during the first four years of the 1990s. In 1999 the amount climbed to US $2,014 million.

Bank lending for population, health, and nutrition has expanded even more rapidly. Average yearly lending to this sector during the 1980s was US$ 207 million, while lending during fiscal 1999 was US$ 1,726 million.

The Environment. The Bank has continued to support environmental protection efforts with loans totaling US$ 978 million in fiscal 1999, compared to US$ 404 million in fiscal 1990. But the full story cannot be told by stand-alone environmental projects. As of the late 1990s, half of all World Bank projects now have an environmental component of some kind.

In fiscal 1993 the World Bank undertook structural changes to respond to growing borrower demand for Bank assistance in environmental issues, and to the need for internal strengthening of monitoring and implementation. A Vice Presidency for Environmentally and Socially Sustainable Development was established. Three departments were placed under this vice presidency—the Environment Department, the Agriculture and Natural Resources Department, and the Transport and Urban Development Department.

The Global Environment Facility is a cooperative venture between the World Bank, the United Nations Development Programme, the United Nations Environment Programme, and national governments. The Facility provides grants to help developing countries deal with environmental problems that transcend boundaries, such as airborne pollution produced by smokestacks or hazardous waste dumped into rivers. The GEF gives priority to four objectives: limiting emissions of greenhouse gases; preserveing biodiversity; protecting international waters; and protecting the ozone layer.

Private Sector Development. The promotion of private sector growth in developing member countries has always been central to the Bank's overall mission of fostering sustainable growth and reducing poverty. In December 1999, the Bank Group announced a restructuring to better align and expand its work related to the private sector. The reforms took effect 1 January 2000. The reorganization tightened the link between the Bank's public sector work and its private sector transactions in the developing world, which are made through the IFC. The World Bank helps governments to formulate policy frameworks that encourage a positive environment for business to function as the primary engine of growth while the IFC, the private sector arm of the Bank Group, provides advice and makes loans and equity investments in companies in developing countries. According to an IFC official the changes were in response to "one of the biggest challenges facing [the Bank's] client countries: How to create a favorable business environment and help finance small and medium enterprises." In addition to creating a new combined unit to coordinate Bank Group activities, help capitalize local financial institutions, and teach them the business of financing small and medium enterprises, the restructuring also involved the creation of joint World Bank-IFC departments, or product groups, for industries where there is a strong interface between public policy and private sector transactions. Three new industry groups, telecommunications/informatics, oil/gas/petrochemicals, and mining, include both policy and transaction capacity. Beyond the new industry groups, the principal advisory services focused on the private sector in both the World Bank and IFC are coordinated under single management.

D. OTHER ACTIVITIES

Technical Assistance. The Bank provides its members with a wide variety of technical assistance, much of it financed under its lending program. The volume of technical assistance in which the Bank is involved as lender, provider, or administrator rose sharply during the 1990s. In addition to loans and guarantees to developing countries, the World Bank carries out its mission by providing advice and assistance with telecommunications sector reform and national information infrastructure strategies. Special programs in this category include InfoDev and TechNet. The Information for Development Program (InfoDev) began in September 1995 with the objective of addressing the obstacles facing developing countries in an increasingly information-driven world economy. It is a global grant program managed by the World Bank to promote innovative projects on the use of information and communication technologies (ICTs) for economic and social development, with a special emphasis on the needs of the poor in developing countries. In recognition of the critical role that science and technology play in promoting economic growth and social progress, in July 1999 TechNet was created as a cross-cutting thematic group to promote knowledge and education in the areas of science and technology and informatics. TechNet acts as a clearing-house and network for professionals inside and outside the Bank.

Interagency Cooperation. The Bank's overarching purpose is helping to reduce global poverty. To this end, the institution encourages the involvement of other development agencies in preparing poverty assessments and works closely with other UN agencies in preparing proposals to improve the quality of poverty-related data. At the country level, the Bank is broadening its efforts to coordinate work with UNDP, UNICEF, and the International Fund for Agricultural Development in specific countries on preparing or following up poverty assessments and planned human development assessments.

Coordination between the Bank and the UN system on poverty at the project level is extensive, particularly in the design of social funds and social action programs. Together with other UN agencies, the World Bank has taken the lead in mobilizing groups of donors, both multilateral and bilateral, to tackle specific areas of concern—for example, the Consultative Group on International Agricultural Research (CGIAR), which is cosponsored by the FAO, UNDP, and the World Bank. The Bank is an active partner in interagency activities which include the follow-up to the World Conference on Education for All and the World Summit for Children; the Safe Motherhood Inter-Agency Group; the Onchocerciasis (riverblindness) Control Programme; the Global Programme for AIDS; and the Task Force for Child Survival. The Bank also has links with the United Nations at the political and policy making level in the work of the General Assembly and its related committees, and the Economic and Social Council.

The Economic Development Institute was the Bank's department responsible for such dissemination. Through seminars, workshops and courses, EDI enabled policy-makers to assess and use the lessons of development to benefit their own policies. On 10 March 1999, the World Bank unveiled the successor to the EDI, the World Bank Institute (WBI). The new learning entity also absorbed the World Bank's Learning and Leadership Center. The WBI drives the Bank's learning agenda, working in three main areas: training, policy services, and knowledge networks. WBI is located at World Bank headquarters in Washington, DC. Many of its activities are held in member countries in cooperation with regional and national development agencies and education and training institutions. The Institute's distance education unit conducts interactive courses via satellite links worldwide. While most of WBI's work is conducted in English, it also operates in Arabic, Chinese, French, Portuguese, Russian and Spanish.

Economic Research and Studies. The Bank's economic and social research program, inaugurated in 1972, is undertaken by the Bank's own research staff and is funded out of its administrative budget. The research program is shaped by the Bank's own needs, as a lending institution and as a source of policy advice to member governments, and by the needs of member countries. Its main purposes are to gain new insights into the development process and the policies affecting it; to introduce new techniques or methodologies into country, sectoral, and project analyses; to provide the analytical bases for major Bank documents, such as the World Development Report; and to help strengthen indigenous research capacity in developing countries.

|

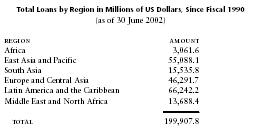

Total Loans by Region in Millions of US Dollars, Since Fiscal

1990

(as of 30 June 2002) |

|

| REGION | AMOUNT |

| Africa | 3,061.6 |

| East Asia and Pacific | 55,088.1 |

| South Asia | 15,535.8 |

| Europe and Central Asia | 46,291.7 |

| Latin America and the Caribbean | 66,242.2 |

| Middle East and North Africa | 13,688.4 |

| ———— | |

| TOTAL | 199,907.8 |

|

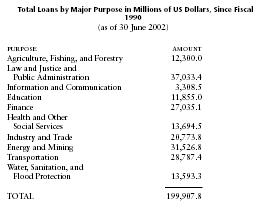

Total Loans by Major Purpose in Millions of US Dollars, Since

Fiscal 1990

(as of 30 June 2002) |

||

| PURPOSE | AMOUNT | |

| Agriculture, Fishing, and Forestry | 12,300.0 | |

| Law and Justice and Public Administration | 37,033.4 | |

| Information and Communication | 3,308.5 | |

| Education | 11,855.0 | |

| Finance | 27,035.1 | |

| Health and Other | ||

| Social Services | 13,694.5 | |

| Industry and Trade | 20,773.8 | |

| Energy and Mining | 31,526.8 | |

| Transportation | 28,787.4 | |

| Water, Sanitation, and Flood Protection | 13,593.3 | |

| ———— | ||

| TOTAL | 199,907.8 | |

As I was going through the website I learned so many things which can be done by this organisation.

I have one question which I want to ask.

I am Tanzanian and I want to built Recycling plant in Tanzania due to the fact that there is none in Tanzanian cities. Rubbish is everywhere and I find this is dangerous and not acceptable. But I do not have funds/money for this project.

Is it possible to get funds/money as a loan or grant to facilitate my project?

Regards,

Davis Mwakitwange

a)New York

b) London

c) Washington

d) Geneva