Malta - Public finance

The principal sources of recurrent revenues are income taxes, and customs and excise taxes. Tourism is steadily increasing as an important segment of the economy, although the September 11 terrorist attacks put a damper on it. Malta has developed a fairly high budget deficit in recent years, and fiscal policy has been dedicated to reversing the situation. Public debt grew from 24% of GDP in 1990 to 56% in 1999, but by 2000 it had been brought down to just 6.6% of GDP.

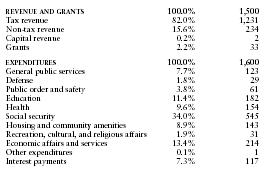

The US Central Intelligence Agency (CIA) estimates that in 2000 Malta's central government took in revenues of approximately $1.5 billion and had expenditures of $1.6 billion. Overall, the government registered a deficit of approximately $100 million. External debt totaled $130 million.

The following table shows an itemized breakdown of government revenues and expenditures. The percentages were calculated from data reported by the International Monetary Fund. The dollar amounts (millions) are based on the CIA estimates provided above.

| REVENUE AND GRANTS | 100.0% | 1,500 |

| Tax revenue | 82.0% | 1,231 |

| Non-tax revenue | 15.6% | 234 |

| Capital revenue | 0.2% | 2 |

| Grants | 2.2% | 33 |

| EXPENDITURES | 100.0% | 1,600 |

| General public services | 7.7% | 123 |

| Defense | 1.8% | 29 |

| Public order and safety | 3.8% | 61 |

| Education | 11.4% | 182 |

| Health | 9.6% | 154 |

| Social security | 34.0% | 545 |

| Housing and community amenities | 8.9% | 143 |

| Recreation, cultural, and religious affairs | 1.9% | 31 |

| Economic affairs and services | 13.4% | 214 |

| Other expenditures | 0.1% | 1 |

| Interest payments | 7.3% | 117 |

Comment about this article, ask questions, or add new information about this topic: