Vietnam - Public finance

The main sources of monetary revenue are income taxes, the sale of SOE's, and customs taxes. Annual deficits are financed by foreign aid. Monetary policy reforms enacted since 1988 helped end the hyperinflationary spiral of the 1980s. Aid from the former Soviet Union, formerly Vietnam's most prominent donor, was greatly reduced after the dissolution of the USSR in 1991. Foreign investment peaked in 1995 after the US declared an end to economic sanctions, but quickly receded thereafter. Implementation of a VAT in 2000 was expected to increase revenue.

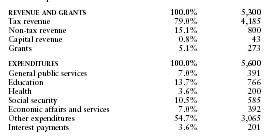

The US Central Intelligence Agency (CIA) estimates that in 1999 Vietnam's central government took in revenues of approximately $5.3 billion and had expenditures of $5.6 billion including capital expenditures of $1.8 billion. Overall, the government registered a deficit of approximately $300 million. External debt totaled $13.2 billion.

The following table shows an itemized breakdown of government revenues and expenditures. The percentages were calculated from data reported by the International Monetary Fund. The dollar amounts (millions) are based on the CIA estimates provided above.

| REVENUE AND GRANTS | 100.0% | 5,300 |

| Tax revenue | 79.0% | 4,185 |

| Non-tax revenue | 15.1% | 800 |

| Capital revenue | 0.8% | 43 |

| Grants | 5.1% | 273 |

| EXPENDITURES | 100.0% | 5,600 |

| General public services | 7.0% | 391 |

| Education | 13.7% | 766 |

| Health | 3.6% | 200 |

| Social security | 10.5% | 585 |

| Economic affairs and services | 7.0% | 392 |

| Other expenditures | 54.7% | 3,065 |

| Interest payments | 3.6% | 201 |

Comment about this article, ask questions, or add new information about this topic: