Philippines - Public finance

The principal sources of revenue are income taxes, taxes on sales and business operations, and excise duties. Infrastructural improvements, defense expenditures, and debt service continue to lead among the categories of outlays.

The government's commitment to fiscal balance resulted in a budget surplus for the first time in two decades in 1994. The surplus was achieved by higher taxes, privatization receipts, and expenditure cuts. The Philippines was not affected as severely by the Asian financial crisis of 1998 as many of its overseas neighbors, as a result of over $7 billion in remittances annually by workers overseas.

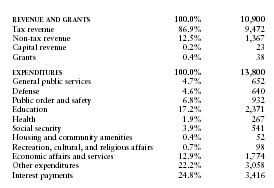

The US Central Intelligence Agency (CIA) estimates that in 2001 the Philippines's central government took in revenues of approximately $10.9 billion and had expenditures of $13.8 billion. Overall, the government registered a deficit of approximately $2.9 billion. External debt totaled $50 billion.

The following table shows an itemized breakdown of government revenues and expenditures. The percentages were calculated from data reported by the International Monetary Fund. The dollar amounts (millions) are based on the CIA estimates provided above.

| REVENUE AND GRANTS | 100.0% | 10,900 |

| Tax revenue | 86.9% | 9,472 |

| Non-tax revenue | 12.5% | 1,367 |

| Capital revenue | 0.2% | 23 |

| Grants | 0.4% | 38 |

| EXPENDITURES | 100.0% | 13,800 |

| General public services | 4.7% | 652 |

| Defense | 4.6% | 640 |

| Public order and safety | 6.8% | 932 |

| Education | 17.2% | 2,371 |

| Health | 1.9% | 267 |

| Social security | 3.9% | 541 |

| Housing and community amenities | 0.4% | 52 |

| Recreation, cultural, and religious affairs | 0.7% | 98 |

| Economic affairs and services | 12.9% | 1,774 |

| Other expenditures | 22.2% | 3,058 |

| Interest payments | 24.8% | 3,416 |

Comment about this article, ask questions, or add new information about this topic: