New Zealand - Public finance

In 1994, in response to a decade of economic reforms that have opened the economy to foreign investment and triggered strong economic growth, the budget produced a surplus for the first time in 50 years. In 1995, public debt service dropped to 1.9% of GDP and 12% of expenditures. External debt accounted for 23% of total government debt. Interest on external debt equaled 3.5% of exports of goods and services plus investment income. The surpluses continued in 1996, but showed signs of weakness in 1997 as forecasts of slower economic growth and uncertainty over the intentions of the newly elected government prompted a drop in business confidence. Nevertheless, in June of 1997, the new government proposed a three-year program of increased spending on social programs and postponed a round of promised tax cuts. As a result of privatization and restructuring, New Zealand now has one of the most open economies in the world.

The US Central Intelligence Agency (CIA) estimates that in 2000/2001 New Zealand's central government took in revenues of approximately $16.7 billion and had expenditures of $16.6 billion. Overall, the government registered a surplus of approximately $100 million. External debt totaled $31.3 billion.

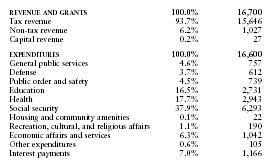

The following table shows an itemized breakdown of government revenues and expenditures. The percentages were calculated from data reported by the International Monetary Fund. The dollar amounts (millions) are based on the CIA estimates provided above.

| REVENUE AND GRANTS | 100.0% | 16,700 |

| Tax revenue | 93.7% | 15,646 |

| Non-tax revenue | 6.2% | 1,027 |

| Capital revenue | 0.2% | 27 |

| EXPENDITURES | 100.0% | 16,600 |

| General public services | 4.6% | 757 |

| Defense | 3.7% | 612 |

| Public order and safety | 4.5% | 739 |

| Education | 16.5% | 2,731 |

| Health | 17.7% | 2,943 |

| Social security | 37.9% | 6,293 |

| Housing and community amenities | 0.1% | 22 |

| Recreation, cultural, and religious affairs | 1.1% | 190 |

| Economic affairs and services | 6.3% | 1,042 |

| Other expenditures | 0.6% | 105 |

| Interest payments | 7.0% | 1,166 |

Comment about this article, ask questions, or add new information about this topic: