Japan - Balance of payments

Beginning in 1981, surpluses in Japan's current accounts increased rapidly, reaching $49 billion in 1985 and $86 billion in 1986, the latter being 18 times the level of 1981. These huge surpluses resulted largely from the high value of the dollar relative to the yen; price declines of primary goods, such as petroleum, also enhanced Japan's favorable trade position. Japan's mounting surpluses and the rising deficits of the US forced the US and other leading industrial nations to attempt to realign their currencies, especially the dollar and the yen, in September 1985. Within two years the yen rose 70% against the dollar. The yen's appreciation increased the competitiveness of American products and contributed to the reduction of Japan's external imbalances through 1990, when the current account surplus fell by 37.4%, due to higher expenses for imported oil and rising expenditures by Japanese traveling abroad. Whereas long-term capital outflows exceeded Japan's current account surplus from 1984 through 1990, by 1991 the outflow shifted predominantly to short-term capital, and overseas direct investment slowed.

The US Central Intelligence Agency (CIA) reports that in 2002 the purchasing power parity of Japan's exports was $383.8 billion while imports totaled $292.1 billion resulting in a trade surplus of $91.7 billion. Japan had the highest trade and current account surpluses in the world in the early 2000s; however, Japan is less open to trade than other highly developed economies. As a percentage of current-price GDP, the value of Japan's two-way foreign trade in 2001 was just 16.8%, compared with Germany's 57% and China's 42.4%. This is due in part to restrictions on merchandise imports to protect the country's less efficient industry sectors. Due to this lack of openness to trade, the country's economy has stagnated, and companies in the nontradable sectors have not been productive.

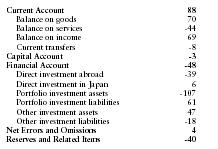

The International Monetary Fund (IMF) reports that in 2001 Japan had exports of goods totaling $384 billion and imports totaling $313 billion. The services credit totaled $65 billion and debit $108 billion. The following table summarizes Japan's balance of payments as reported by the IMF for 2001 in billions of US dollars.

| Current Account | 88 |

| Balance on goods | 70 |

| Balance on services | -44 |

| Balance on income | 69 |

| Current transfers | -8 |

| Capital Account | -3 |

| Financial Account | -48 |

| Direct investment abroad | -39 |

| Direct investment in Japan | 6 |

| Portfolio investment assets | -107 |

| Portfolio investment liabilities | 61 |

| Other investment assets | 47 |

| Other investment liabilities | -18 |

| Net Errors and Omissions | 4 |

| Reserves and Related Items | -40 |

Comment about this article, ask questions, or add new information about this topic: