Costa Rica - Balance of payments

Costa Rica has traditionally experienced balance-of-payments difficulties because of the vulnerability of its main sources of exchange earnings to fluctuations in world markets. The nation's payments problems in the late 1970s were aggravated by domestic inflationary policies and rising trade imbalances, despite increases in foreign capital receipts. The deficit on capital accounts declined in the mid-1980s due to increases in capital investment from foreign loans and credits and favorable renegotiation of the foreign debt. During the early 1990s, an unfavorable trade balance resulted from fluctuating coffee prices and high oil prices, but the balance of payments leveled out by 1999. Costa Rica's chronic trade and current account deficits have been offset by foreign direct investment in the form of capital goods, which is reflected in the offsetting figures for the current and capital accounts.

The US Central Intelligence Agency (CIA) reports that in 2001 the purchasing power parity of Costa Rica's exports was $5 billion while imports totaled $6.5 billion resulting in a trade deficit of $1.5 billion.

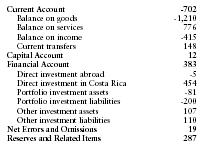

The International Monetary Fund (IMF) reports that in 2001 Costa Rica had exports of goods totaling $4.91billion and imports totaling $6.12 billion. The services credit totaled $2.05 billion and debit $1.28 billion. The following table summarizes Costa Rica's balance of payments as reported by the IMF for 2001 in millions of US dollars.

| Current Account | -702 |

| Balance on goods | -1,210 |

| Balance on services | 776 |

| Balance on income | -415 |

| Current transfers | 148 |

| Capital Account | 12 |

| Financial Account | 383 |

| Direct investment abroad | -5 |

| Direct investment in Costa Rica | 454 |

| Portfolio investment assets | -81 |

| Portfolio investment liabilities | -200 |

| Other investment assets | 107 |

| Other investment liabilities | 110 |

| Net Errors and Omissions | 19 |

| Reserves and Related Items | 287 |

Comment about this article, ask questions, or add new information about this topic: