Brazil - Balance of payments

After a decline in the mid-1960s, Brazil's reserve holdings grew spectacularly, reaching $6.5 billion by 1974. The prime reason was a steadily rising inflow of long-term capital investment, coupled with trade balances that were favorable or only minimally unfavorable. In 1974, however, a decline in the value of coffee exports and a doubling of import costs (partly attributable to increased oil prices) more than offset a further rise in capital investment, resulting in Brazil's first payments deficit in nearly a decade. Between 1976 and 1978, Brazil had a positive balance of payments, but large deficits were registered in 1979 and 1980. A surplus was achieved in 1981, in part because of Brazil's excellent trade showing. The surpluses in 1984 and 1985 were sufficient to pay all interest on the foreign debt. During the 1970s and early 1980s, Brazil increasingly came to rely on international borrowing to meet its financing needs. The foreign debt grew rapidly after 1974 as the government pressed for continued economic growth without regard for balance of payments pressures generated by the oil shocks of the later 1970s and without increasing domestic savings or improving the tax base. The huge trade surpluses of 1984 and 1985 halted the upward trend. However, the 1986 surge in consumer spending drained reserves to such an extent that by early 1987, the government was forced to suspend payments on $68 billion of the estimated $108 billion debt, the highest of any developing nation. An agreement was reached in April 1991 on 1989–90 arrears. In 1992, Brazil and the advisory committee representing foreign commercial banks agreed to a debt and debt service reduction for $44 billion. Under the Real Plan, the balance of payments dropped from a surplus of $10.5 billion in 1994 to a deficit of $3.1 billion in 1995, -$5.5 billion in 1996, and -$8.4 billion in 1997. This transformation in Brazil's trade position was due to an overvalued exchange rate, market opening, and suppressed demand for capital and consumer goods. A devaluation of the currency in 1999 led to a reduction of the trade deficit in 1999 and in 2000. In 2000, foreign direct investment reached a record $32.8 billion. That year, Brazil ran a $24.6 current account deficit, due in large measure to payment on its $17 billion foreign debt.

The US Central Intelligence Agency (CIA) reports that in 2001 the purchasing power parity of Brazil's exports was $57.8 billion while imports totaled $57.7 billion resulting in a trade surplus of $100 million.

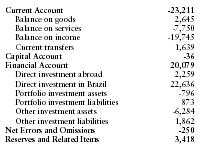

The International Monetary Fund (IMF) reports that in 2001 Brazil had exports of goods totaling $58.2 billion and imports totaling $55.6 billion. The services credit totaled $9.3 billion and debit $17.1 billion. The following table summarizes Brazil's balance of payments as reported by the IMF for 2001 in millions of US dollars.

| Current Account | -23,211 |

| Balance on goods | 2,645 |

| Balance on services | -7,750 |

| Balance on income | -19,745 |

| Current transfers | 1,639 |

| Capital Account | -36 |

| Financial Account | 20,079 |

| Direct investment abroad | 2,259 |

| Direct investment in Brazil | 22,636 |

| Portfolio investment assets | -796 |

| Portfolio investment liabilities | 873 |

| Other investment assets | -6,284 |

| Other investment liabilities | 1,862 |

| Net Errors and Omissions | -250 |

| Reserves and Related Items | 3,418 |

Comment about this article, ask questions, or add new information about this topic: