Tunisia - Public finance

Each year, an administrative budget and a development budget are submitted to the National Assembly. Levies on imports provide the major sources of current revenue, but trade agreements with the WTO and the EU will disturb this pattern. Government spending amounted to about half of GDP in 1999, 60% of which was spent on social projects. The Tunisian government's economic reform programs are lauded as some of the best in the world by international financial institutions. Reforms included liberalized prices, reduced tariffs, and lowered debt-to-GDP ratios. Since the privatization program was launched in 1987, about 140 state-owned enterprises had been fully or partially privatized as of 2002.

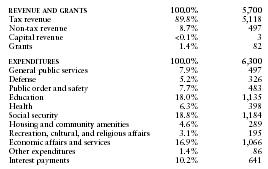

The US Central Intelligence Agency (CIA) estimates that in 2001 Tunisia's central government took in revenues of approximately $5.7 billion and had expenditures of $6.3 billion including capital expenditures of $1.5 billion. Overall, the government registered a deficit of approximately $600 million. External debt totaled $11.5 billion.

The following table shows an itemized breakdown of government revenues and expenditures. The percentages were calculated from data reported by the International Monetary Fund. The dollar amounts (millions) are based on the CIA estimates provided above.

| REVENUE AND GRANTS | 100.0% | 5,700 |

| Tax revenue | 89.8% | 5,118 |

| Non-tax revenue | 8.7% | 497 |

| Capital revenue | <0.1% | 3 |

| Grants | 1.4% | 82 |

| EXPENDITURES | 100.0% | 6,300 |

| General public services | 7.9% | 497 |

| Defense | 5.2% | 326 |

| Public order and safety | 7.7% | 483 |

| Education | 18.0% | 1,135 |

| Health | 6.3% | 398 |

| Social security | 18.8% | 1,184 |

| Housing and community amenities | 4.6% | 289 |

| Recreation, cultural, and religious affairs | 3.1% | 195 |

| Economic affairs and services | 16.9% | 1,066 |

| Other expenditures | 1.4% | 86 |

| Interest payments | 10.2% | 641 |

Comment about this article, ask questions, or add new information about this topic: